BUILT FOR EMPLOYER GROUPS

LEVREDGE

Transform your employee’s health with our Section 125 Group Fixed Hospital Indemnity Program. Bolstered by a strategic alliance with an A-rated carrier, we collaborate closely with you to tailor a solutions package perfectly suited to your business, achieving greater organizational savings.

BUILT FOR EMPLOYER GROUPS

LEVREDGE

Transform your employee’s health with our Section 125 Group Fixed Hospital Indemnity Program. Bolstered by a strategic alliance with an A-rated carrier, we collaborate closely with you to tailor a solutions package perfectly suited to your business, achieving greater organizational savings.

WHAT LEVREDGE DOES

HEALTH BENEFITS

Our LEVREDGE Program addresses overlooked gaps left by traditional major medical insurance plans. LEVREDGE, a supplemental benefit program that works with any existing major medical plan, includes some amazing features:

- Group-fixed hospital indemnity plan

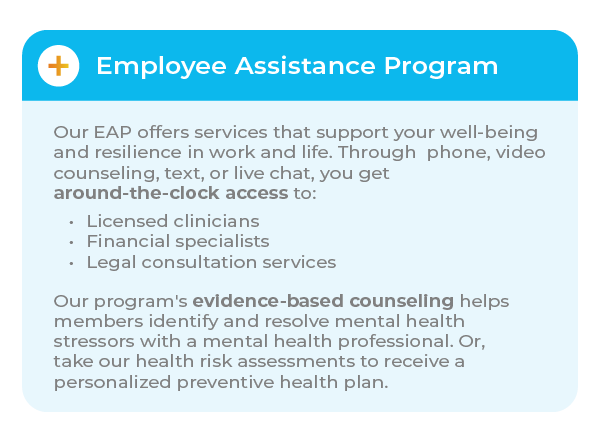

- Employee Assistance Program (EAP)

- 24/7 Telehealth services for you & your dependents

- Evaluations of individual health risk and wellness levels.

LEVREDGE guides participants towards healthier lifestyle choices and preventive care services. Connect individuals and families to coverage that meets a broad spectrum of healthcare needs.

SAVINGS FROM TOP TO BOTTOM

Our clients achieve pre-tax savings with our program, which features a Section 125 pre-tax deduction that reduces the taxable income of their workforce. Employees participating in at least one preventive healthcare activity per month may benefit from increased take-home pay, courtesy of post-tax claims for qualified activities.

WHAT LEVREDGE DOES

HEALTH BENEFITS

Our LEVREDGE Program addresses overlooked gaps left by traditional major medical insurance plans. LEVREDGE, a supplemental benefit program that works with any existing major medical plan, includes some amazing features:

- Group-fixed hospital indemnity plan

- Employee Assistance Program (EAP)

- 24/7 Telehealth services for you & your dependents

- Evaluations of individual health risk and wellness levels.

LEVREDGE guides participants towards healthier lifestyle choices and preventive care services. Connect individuals and families to coverage that meets a broad spectrum of healthcare needs.

SAVINGS FROM TOP TO BOTTOM

Our clients achieve pre-tax savings with our program, which features a Section 125 pre-tax deduction that reduces the taxable income of their workforce. Employees participating in at least one preventive healthcare activity per month may benefit from increased take-home pay, courtesy of post-tax claims for qualified activities.

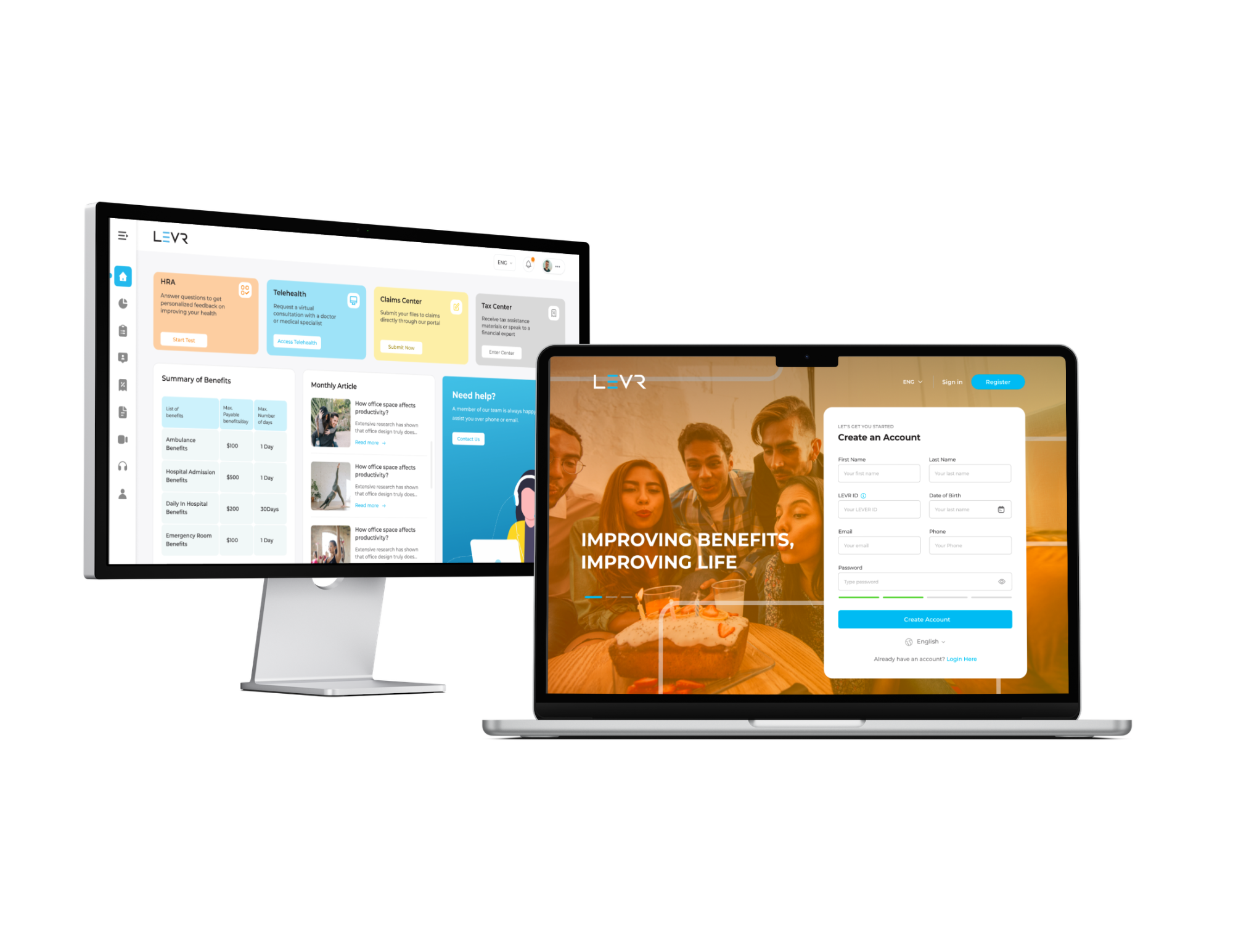

OUR PORTAL IN ACTION

ALL YOUR EMPLOYEE'S BENEFITS IN ONE SPOT

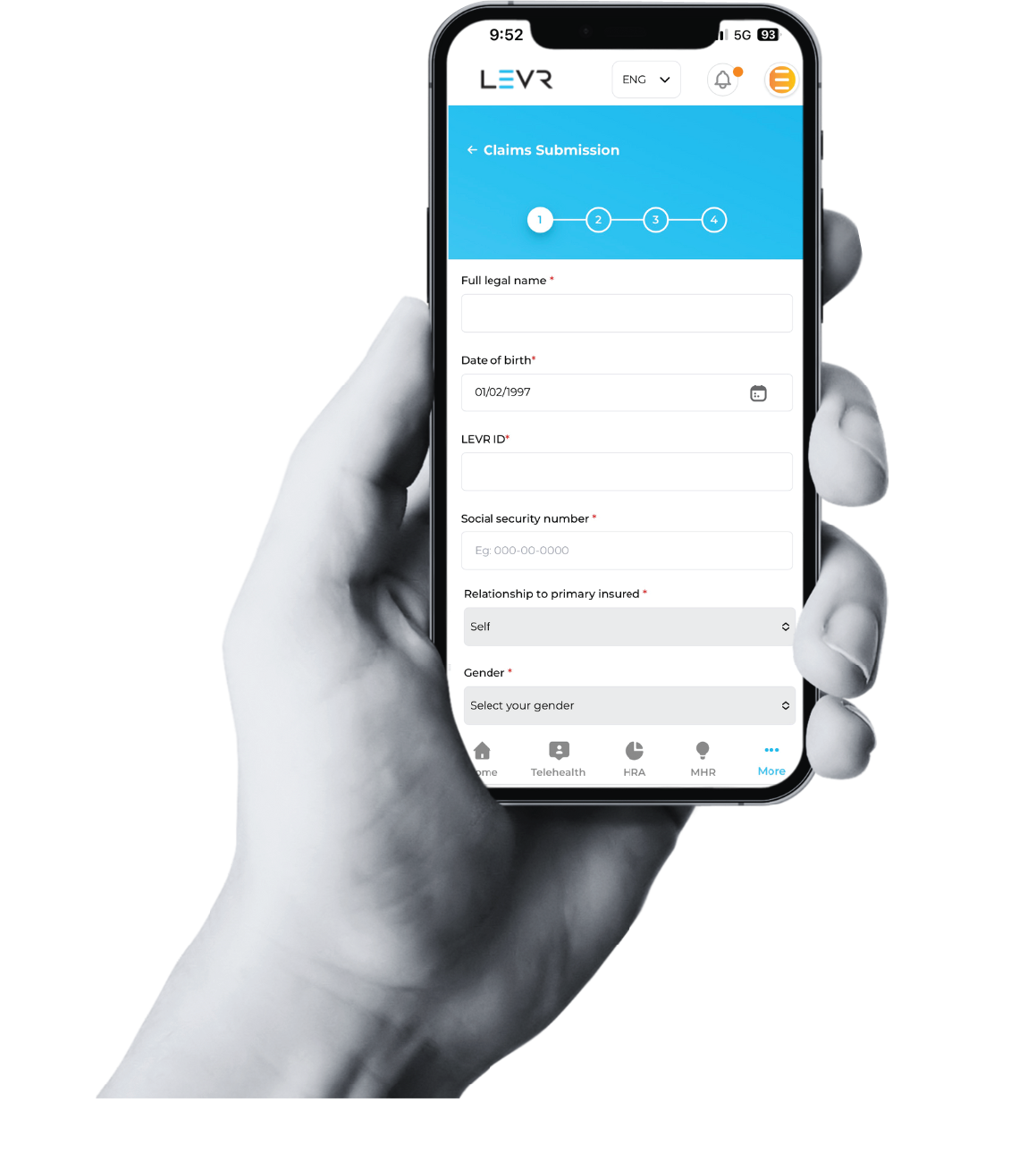

Members can access their benefits anytime, anywhere with our health portal using any smart device. Seamlessly connect with clinical professionals, submit claims, explore your personalized health library, and unlock other features—with a single, user-friendly login.

GROUP FIXED HOSPITAL INDEMNITY PLAN

CARE COMPENSATION

Our plan helps offer financial protection in the event of hospitalization. Fixed payments are received for hospital stays, ambulance services, emergency room visits, and other medical expenses. With our support, you can prioritize your recovery without worrying as much about financial burdens.

- Fixed compensation per covered medical event.

- Flexible coverage options to suit your individual needs and budget.

- Streamlined claims process with swift reimbursement.

GROUP FIXED HOSPITAL INDEMNITY PLAN

CARE COMPENSATION

Our plan helps offer financial protection in the event of hospitalization. Our plan ensures coverage for hospital stays, ambulance services, emergency room visits, and other medical expenses. With our support, you can prioritize your recovery without worrying as much about financial burdens.

- Fixed compensation per covered medical event.

- Flexible coverage options to suit your individual needs and budget.

- Streamlined claims process with swift reimbursement.

EMPLOYER HUB

STAY IN THE KNOW WITH OUR EMPLOYER DASHBOARD

Monitor your program analytics effortlessly with our real-time, intuitive dashboards. Gain instant access to crucial metrics and insights, empowering you to make well-informed decisions and maximize your benefits.

WE LOVE QUESTIONS

Is LEVREDGE major medical health insurance?

No, it’s not. LEVREDGE is a supplemental program that works alongside any health coverage you already have. It doesn’t replace or interfere with your major medical insurance through your employer.

If you’re looking to explore ways to save on major medical insurance, check out our medical captives option.

How is the LEVREDGE Program’s claim payment paid to an employee?

It depends on the type of claim:

- Health Screening Benefit Claims: When an employee completes an eligible activity, the claim payment is processed through payroll and included in their regular paycheck.

- Hospital-Related Claims (Group Fixed Hospital Indemnity Plan): For events like an ER visit or hospital stay, the claim payment is issued directly to the employee by check.

Each type of claim follows its own process, but both are paid directly to the employee.

GET STARTED

LET'S BUILD BETTER EMPLOYEE BENEFITS TOGETHER

GET STARTED

LET'S BUILD BETTER EMPLOYEE BENEFITS TOGETHER

THIS IS A LIMITED BENEFIT POLICY. The insurance described in this document provides limited benefits. Limited benefits plans are insurance products with reduced benefits intended to supplement comprehensive health insurance plans. This insurance is not an alternative to comprehensive coverage. It does not provide major medical or comprehensive medical coverage and is not designed to replace major medical insurance. Further, this insurance is not minimum essential benefits as set forth under the Patient Protection and Affordable Care Act.

This is a brief description of coverage provided under group policy form numbers, HIP-30000P and HIP-30000R-HSI, and is subject to the terms, conditions, limitations and exclusions of the policy. Please see the policy and certificate for complete details. Coverage may vary or may not be available in all states.

Insurance benefits are underwritten by United States Fire Insurance Company. C&F and Crum & Forster are registered trademarks United States Fire Insurance Company. The Crum & Forster group of companies is rated A (Excellent) by AM Best Company 2024.